How to use our equity release calculator

There are just three simple steps to using our instant equity release calculator - no personal details are needed.

1

Enter Property Value and Age

Your property value and age have the biggest impact on how much you can release.

2

Choose your property type, ownership and country

This improves accuracy, as lenders vary criteria across the UK.

3

View your instant results

We compare every UK equity release lender and show you four calculations:

- Lowest Standard Interest Rate (min & max available at this rate)

- Average Loan (average rate + max release at this rate)

- Maximum Standard Release

- Maximum Medical Enhancement

On the calculator results page, you can also:

- See how the equity release loan accrues interest over time

- See the monthly payment required to service the interest (avoiding compound interest)

- Model future property growth vs your equity release (to understand inheritance impact)

- Download your calculator results in a PDF

Why use our equity release calculator?

- Free and completely anonymous

- Instant results from all equity release lenders

- No personal details until you choose to take the next step

- Accurate calculations updated regularly

- Used by over 100,000 people each year

As proud members of the Equity Release Council, all plans we recommend follow their strict consumer protection standards.

Now that you know how to use our calculator, let's explore its functionality in more detail and learn how to optimise the results from our tool.

In this guide, you will learn:

To calculate the maximum loan available on an equity release plan, you require the age of the youngest homeowner and the property value. Plans start from age 55 when you can release a maximum of 29.1% of your property's value. On average, you can release an extra 1% on each birthday, up to a maximum of 59.05%.

But how do you know what percentage to use?

That's where over a decade of experience and research comes in. Over 100,000 people use our equity release calculator each year, and we've helped clients release over £132 million.

We regularly update the loan amounts and interest rates offered by equity release lenders, and I've included a table showing the latest maximum LTV's by age later in this guide.

By speaking with each equity release lender, we've distilled the biggest levers impacting how much they will lend.

Your property value

Most lenders accept homes from £70,000–£100,000+, with different limits by property type.

Age-based loan-to-value (LTV) percentages

Lenders use the age of the youngest homeowner to determine the maximum percentage of your property value they’ll lend.

Whether you are applying singly or jointly

Joint applications usually receive a slightly lower maximum release, as lenders expect the plan to run longer.

The Country that you live in

Some lenders offer different terms in Scotland, England/Wales, and Northern Ireland.

Using these inputs, our calculator instantly compares your details against every plan on the market.

Why don't we need personal details?

We know that providing personal information, such as your address, telephone, and email address, will result in one thing... being contacted.

That's why our calculator to be different.

We don't want your personal details until you are ready to take the next step and speak with us.

Now, there are some benefits in knowing your address - you can get a more accurate quotation.

So, once you have used our calculator, which doesn't require any personal details, we offer you the option to provide them and request your personalised Key Facts Illustration.

Importantly, this is only when you are ready and puts you in control.

Understanding these percentages is essential when interpreting your calculator results.

You will typically be able to release up to 29.1% at age 55, and up to 59.05% of the market value of your home over time.

The age of the youngest homeowner significantly impacts the maximum percentage you can take on an equity release plan. The age provides us with a Loan-to-Value (LTV) ratio, which is the maximum percentage of the property's value that the equity release lender can lend.

What is the maximum percentage you can get on equity release by age:

| Age of youngest homeowner |

Maximum percentage of property value which can be released (LTV) with a lifetime mortgage (equity release) |

| Standard terms |

Medically enhanced |

| 55 |

29.1% |

34% |

| 56 |

30% |

35.2% |

| 57 |

30.8% |

36.4% |

| 58 |

31.7% |

37.2% |

| 59 |

32.6% |

37.6% |

| 60 |

33.65% |

37.5% |

| 61 |

34.9% |

38% |

| 62 |

36.25% |

38.6% |

| 63 |

37.5% |

39.3% |

| 64 |

38.75% |

39.8% |

| 65 |

40% |

40.8% |

| 66 |

41.35% |

41.7% |

| 67 |

42.35% |

42.7% |

| 68 |

43.35% |

43.8% |

| 69 |

44.65% |

44.9% |

| 70 |

45.5% |

42.5% |

| 71 |

46.75% |

47.4% |

| 72 |

47.5% |

48.8% |

| 73 |

48.5% |

50.3% |

| 74 |

50% |

51.8% |

| 75 |

51% |

53.3% |

| 76 |

52.4% |

54.9% |

| 77 |

53.9% |

56.4% |

| 78 |

55.5% |

58% |

| 79 |

57.1% |

59.6% |

| 80 |

57.6% |

60% |

| 81 |

57.7% |

60% |

| 82 |

57.9% |

60% |

| 83 |

59.05% |

60% |

| 84 |

59.05% |

60% |

| 85 |

59.05% |

60% |

| 86 |

59.05% |

42.9% |

| 87 |

59.05% |

43% |

| 88 |

59.05% |

43% |

| 89 |

59.05% |

43% |

| 90 |

57.9% |

42.6% |

| 91 |

57.9% |

42.9% |

| 92 |

57.9% |

43% |

| 93 |

57.9% |

43% |

| 94 |

57.9% |

43% |

| 95 |

57.9% |

43% |

| 96 |

57.9% |

43% |

| 97 |

57.9% |

43% |

| 98 |

57.9% |

43% |

| 99 |

57.9% |

43% |

To find the maximum equity release loan amount, you need to multiply the LTV by your property value.

Examples calculations on a £300,000 house:

At age 55:

Perfect Health - The maximum equity release is £87,300 (£300,000 x 29.1%)

Medically Enhanced - The maximum equity release is £102,000 (£300,000 x 34.0%)

At age 60

Perfect Health - The maximum equity release is £100,950 (£300,000 x 33.7%)

Medically Enhanced - The maximum equity release is £112,500 (£300,000 x 37.5%)

At age 70

Perfect Health - The maximum equity release is £136,500 (£300,000 x 45.5%)

Medically Enhanced - The maximum equity release is £127,500 (£300,000 x 42.5%)

At age 80

Perfect Health - The maximum equity release is £172,800 (£300,000 x 57.6%)

Medically Enhanced - The maximum equity release is £180,000 (£300,000 x 60.0%)

At age 90

Perfect Health - The maximum equity release is £173,700 (£300,000 x 57.9%)

Medically Enhanced - The maximum equity release is £127,800 (£300,000 x 42.6%)

Please note: The above figures are for a standard construction freehold house in England. Should you wish to release more, other financial products may be available, including a Home Reversion Plan or a Retirement Interest Only Mortgage. Please contact us for further information surrounding these different types of plans.

To find out how much you could release, use our equity release calculator; it requires no personal contact information, and the results are instant.

The youngest homeowner's age significantly impacts the maximum percentage you can release; however, this is not the only factor.

Medically underwritten equity release plans

A medically enhanced equity release plan can allow you access to larger release amounts and lower interest rates.

With a medically underwritten lifetime mortgage, the lender will take into consideration your health and lifestyle. The lender asks a set of simple questions and will consider how your answers could impact on your life expectancy.

Aviva is one of three lenders that consider your medical history and lifestyle factors.

I have created a specific Aviva equity release calculator where you can provide your medical information to receive your tailored quote.

Once you have used the Aviva calculator, we also provide you with quotes from all other lenders, including medical quotes from both More2Life and Just.

The lender considers the impact that your answers could have on your life expectancy.

If the lender believes you will live shorter than average, they will anticipate being repaid sooner, and treat you as if you were older.

As you can see in the grid above, the impact on the maximum amount available for medically enhanced plans can be substantial.

The younger you are, the more significant the impact could be!

The exact enhancement will depend on the number and severity of the conditions and lifestyle factors. Our calculator takes into consideration the maximum enhancements available.

To see how your conditions impact your medical enhancement, request your Key Facts Illustration.

Lender fees

With some equity release plans, you may incur an arrangement fee with the lender.

You are not required to pay the arrangement fee up front. Most lenders allow you to either deduct the arrangement fee from the loan amount or add it.

If you are trying to obtain the maximum amount available, I would suggest adding any arrangement fee to the loan amount.

Equity release plans with cashback

Some equity release plans also include cashback. Cashback can be great as it is in addition to the loan amount, and it does not attract any interest.

The cashback you receive can be used for anything you wish. However, it can be a great way to help pay for any setup fees associated with your plan.

Some lenders offer you a fixed sum regardless of your release amount. For example, some Pure Retirement lifetime mortgages provide £895 cashback on completion.

However, some lenders provide you with a percentage of the amount released. For example, 2% or even 5% extra.

The grid above does not include any cashback that you may be able to receive, but our calculator will show you plans, including cashback!

Joint vs Single

We've already explored how applying jointly can reduce the maximum equity release. You might be considering applying solely to avoid the reduction in the maximum loan.

The majority of lenders require that if an applicant is married, the equity release application be made in joint names.

But there are times when you may wish to apply in one name only, including:

- Where the property is already owned in one name;

- Where the spouse's primary residence is a different property;

- Where the youngest applicant is below the age of 55 (the minimum age for equity release plans);

- When one spouse is older, you may apply in one name to obtain more money or a lower interest rate.

When using our calculator...

- Choose "Married Sole App" if you are married but are applying solely in one name.

- Choose "Joint" if you wish to add your spouse to the title deeds and apply jointly.

This will help ensure that you receive the correct results.

Equity Release Supermarket conducted a survey and found that over 80% of calculators gave inaccurate results.

We regularly check loan amounts and interest rates from all providers to provide you with the most accurate results.

The Money Release equity release calculator includes plans from all equity release providers, including:

- Aviva

- Canada Life

- Just

- Legal & general

- LiveMore

- LV=

- More 2 Life

- Pure Retirement

- Royal London

- Standard Life

Your actual release may differ because of your individual circumstances. Once you have used our equity release calculator, request a Key Facts Illustration from one of our qualified equity release advisors for an exact quote from an equity release lender.

It may be possible to achieve a lower interest rate than the calculator suggests.

Some lenders give discounts if you make payments. If you can agree to make regular repayments, you could get a discount of up to 1% on the interest rate!

Some lenders give interest rates for specific loan amounts. Once we know what specific loan amount you are trying to achieve, we may be able to get you a lower interest rate than the calculator suggests.

But, remember, we work with every equity release provider. And the best part is that we know that you can't find a better deal elsewhere.

In fact, we're so confident that we offer the Money Release Guarantee.

We guarantee we will get you the best deal. If you find a better deal elsewhere, we will give you £50*.

Your medical information may give you different personalised enhancements.

Our calculator uses severe medical conditions to show you the maximum medical enhancements available in the market.

However, depending on your specific medical conditions, you may not be able to release as much money.

Other factors can reduce the number of plans available, which could impact on the maximum release amount available to you. These include:

Property construction

Your property's construction can impact the number of equity release plans available.

Whilst we have seen lenders become much more relaxed with equity release underwriting, there are still limitations on some types of property.

The equity release security, your home, is of paramount concern to all equity release lenders. This is because, for most applicants, the sale proceeds of the property will be the vehicle used to repay the loan in the future.

For this reason, the equity release lender wants to lend on properties which they believe are more likely to sell at fair market value in the future.

If you live in a property that is not built of bricks and stone and does not have a tiled pitched roof, you may find that you cannot access all equity release plans, and therefore, you could receive a lower maximum release amount.

Plan features

Equity release plans have continued to become more and more flexible over recent years, with new plan features across a range of financial products.

As part of my financial advice, I will discuss what you feel your future holds and detail plan features that may benefit you.

For example, you may live in a large home with high running costs.

While you and your spouse live together, you want to remain in your home. However, if there were just one of you living in the property, you may not want or have the financial means to stay.

A great feature which may be appropriate is to look for a solution which includes a "significant life event exemption".

This exemption allows you to repay your existing equity release within three years of the death of the first borrower or the first borrower moving into long-term care without incurring an Early Repayment Charge.

Having the maximum release or the lowest interest rate may not be your best solution. As a part of our financial advice meeting, I will explore all features with you and recommend a plan that best meets your needs.

Click here to arrange your free consultation.

Lodgers

With all equity release plans, other people can live with you. However, if you have a tenancy agreement in place or are receiving an income from those living with you, it may limit the number of plans available to you.

Second / Holiday homes / Buy-to-let

Equity release lenders currently only allow you to take a plan on your primary residence (your main home).

But what if you own a different property on which you wish to take equity release?

We can explore other financing options you could arrange on the properties, such as a buy-to-let mortgage that requires monthly payments.

Your calculator results include estimated rates for each of the four calculations. So, the best way to see is to use our equity release calculator. But, here's a rough guide on what interest rate you can expect.

Our general rule is that an interest rate of 5% is excellent, 6% is average, and 7% plus is for more substantial borrowing with the most product features.

Remember: Lifetime mortgage rates can be fixed for life, meaning you can borrow money long-term without making mandatory monthly payments.

There are currently no other ways of borrowing money similarly at such little cost!

Do you want to find out more? Use our equity release calculator to find out what interest rates you can achieve.

For most equity release plans, interest will be accrued daily and added to the mortgage monthly. On this basis, many lenders express their interest rates as a Monthly Equivalent Rate (or MER for short).

But if you are not planning to make payments, is this the figure that you should be considering?

While showing a 'lower' interest rate may look more attractive, I believe that the MER is usually not the most appropriate interest rate. For this reason, I will always provide you with the Annual Equivalent Rate (AER).

But what's the difference?

Put simply, the AER shows how interest accrues every year when you do not make any payments and your mortgage runs.

Note: Make sure that you understand if the rate you are quoted is MER or AER. You must compare the same type of interest rate on different financial products. I often use the phrase "you shouldn't compare apples to pears".

You are not required to make any interest payments during the life of the equity release plan, although you can choose to make payments if you wish.

At the end of the equity release plan (when you move into permanent long-term care or pass away), you must repay the money borrowed and the interest charged.

You can view our compound interest calculator here. There's also a cost calculator on the results page of our equity release calculator.

You typically qualify if:

- You're 55+

- You own a UK property worth £70,000+

- You can clear any existing mortgage using the release

I have written a complete guide on equity release eligibility, which explores eligibility criteria in greater detail.

Equity release allows you to release tax-free money from your home without selling it.

The most popular form is a lifetime mortgage, which:

- Requires no monthly repayments (unless you choose)

- Has no fixed end date

- Is repaid when you die or move into long-term care

- Is fully regulated by the FCA

- Includes the No Negative Equity Guarantee

See our equity release guide, which deep dives into the full mechanics of how plans work.

Equity release isn't right for everyone, and we explore all alternative options with you.

The most popular alternative is downsizing to a cheaper property to release money instead.

We are also seeing an increase in younger customers who can afford to make payments who we might recommend a residential mortgage instead.

I've written a guide on alternatives to equity release, in which we explore eleven different options.

What does Martin Lewis think about equity release?

Martin Lewis has many great tips and tricks to save money, but what are his opinions on equity release?

Martin Lewis states equity release can be a good financial product if you require the funds and are not concerned about the impact on leaving an inheritance. However, he says equity release can be expensive and to always consider downsizing first, as he believes it is the easiest way to release equity from your home.

Martin Lewis has many thoughts on equity release; some are important to listen to, and others need further clarification. You can read more about Martin Lewis and equity release here.

Once you have entered your details into our equity release calculator, hit "calculate now". This will get the calculator to crunch the numbers and provide you with your results.

On the results page, you will find four individual results:

- The lowest standard rate plan

- The average loan

- The maximum standard release

- The maximum medical enhancement

You will see that the more money you want to release, the higher the interest rate you will likely be charged.

But, the equity release calculator only provides four results, so you may wonder what interest rate you can achieve for a specific loan amount.

You have the option to:

Compare the latest equity release deals

By providing your contact details and your specific requested loan amount, you will receive your personalised equity release market report.

We will also give you a call to discuss your best options.

There's no obligation to proceed - we simply want you to have the most up-to-date personalised information, to help make an informed decision.

Speak with a qualified advisor

If you are ready to speak with a qualified equity release advisor, you will have the option to book an appointment directly into one of their diaries.

You can book your free equity release appointment at a time that best suits you.

The initial appointment will be conducted over the phone, and a home visit can be arranged if you or your advisor wishes.

What happens after you apply?

Following your initial consultation, the advisor will research the best plans for your needs and make you a formal recommendation.

If the advisor recommends equity release and you wish to proceed, they will send you an information pack, along with a pre-paid special delivery envelope for you to return signed documents.

We make the rest of the process as simple as possible:

- Instructing the lender

- Arranging your home's valuation

- Liaising with your solicitor for your mortgage signing appointment

- Getting you your funds as quickly as possible.

Applications can be completed in a matter of weeks - and you can enjoy your cash as you wish.

What our clients have to say

Here are just a few of our latest reviews. All these people started their journey with Money Release by using our equity release calculator.

Asha was warm, friendly, and explained everything clearly.

Marion H

Marion H

Service was impeccable from start to finish.

SSidd

SSidd

Professional, patient and no pressure at any point.

Joanna M

Joanna M

We're always on hand to answer any questions that you have about equity release. Feel free to give us a call on 0207 158 0881 and one of our friendly team will be happy to help.

Below are some of the questions that our team are frequently asked.

How safe is equity release?

Equity release is fully regulated by The Financial Conduct Authority (F.C.A.) which ensures that only regulated and approved companies may offer advice. As members of the Equity Release Council, Money Release Limited only recommends equity release plans that comply to their latest standards.

Could I lose my house?

As there are no monthly payments to make with an equity release plan, it is impossible to fall behind with payments and therefore impossible to lose your home. You are guaranteed that you can stay in your home until you either pass away or move into a permanent long-term care home.

Can I move house?

Equity release plans are portable, which means that you are free to move at any point (subject to provider criteria), or indeed stay in the property for as long as you choose.

Can I make sure I still leave an inheritance?

Many customers are concerned about leaving behind an inheritance to their loved ones after they have passed away. We offer plans that ensure a percentage of your home is protected for the purpose of inheritance planning so you can be confident your wishes are met.

Can I really use the money for whatever I want?

Absolutely yes! After all, it's your money. Some of the most popular reasons include home improvements, paying off credit card and loan debts, or simply having a little extra to spend each month.

Does using the equity release calculator affect my credit score?

No. Using our calculator is entirely confidential and does not involve a credit check.

Do I need to speak with an advisor after using the calculator?

No – the calculator provides instant results with no obligation to speak to an advisor. However, if you want tailored recommendations, our advisors can explain your options in more detail.

Now that we have explored the possible maximum release amounts available to you, and discussed the range of interest rates in the market, you may wish to compare the equity release plans individually open to you.

Our equity release calculator provides you with four tailored quotations. To compare the full range of plans available, use our equity release calculator, and you will find out how to access our equity release comparison tool.

Our market-leading equity release comparison tool finds the most cost-effective equity release plan for the amount you need.

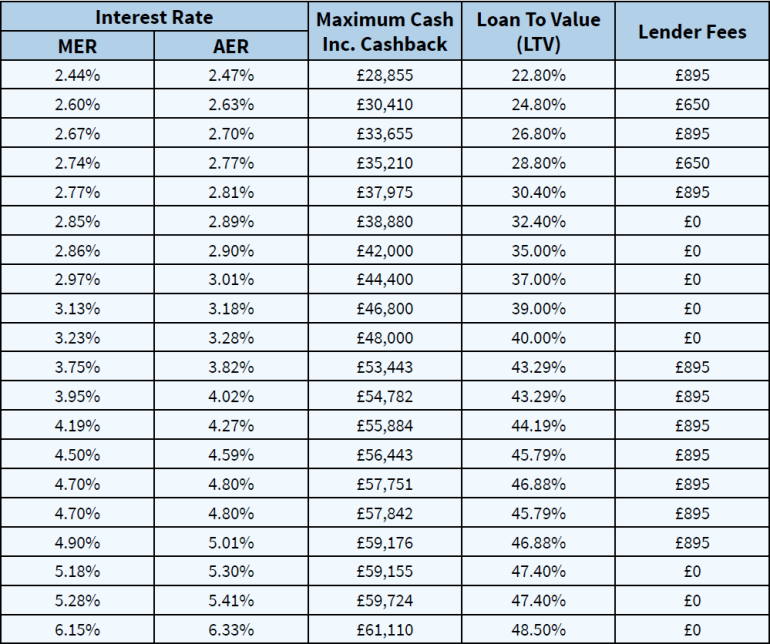

Let's look at a sample extract from an equity release report for a 75-year-old homeowner in England with a £271,000 freehold house.

To begin, use our equity release calculator; it requires no personal contact information, and the results are instant.

If you have further questions, why not speak with one of our qualified advisors?

Call us on 0207 158 0881 or use our online form to book your FREE consultation.

While a qualified equity release advisor has written this guide, it is not intended to be used as financial nor legal advice and should not be relied upon.

To understand the full features and risks of an Equity Release plan, ask for a personalised illustration.

Did this article answer your question?

If you found this article interesting, why not share it with your friends?

Simply click on the icons below to share.