Equity release has been around for decades, but the types of plan, features, and safeguards have changed drastically over time.

Overall plans have become more feature rich, flexible, and safer. While this is fantastic news, the amount of out-dated information about equity release is vast. So, what is equity release in 2025?

Equity release plans allow UK homeowners aged 55 and above access to some of the equity built up in their property. Equity release provides cash lump sums or regular income which does not need repaying until you pass away or move into care. Your estate then repays the lender, usually from your property's sale proceeds.

I will break down everything that you need to know about equity release so that you can decide if it could be an option for you.

How do you qualify for equity release?

To qualify for equity release, you must be age 55 and over. The property you take equity release on (the security), must be valued over £70,000, and you must clear any mortgages when the equity release starts. You can use the funds from equity release to repay any mortgage.

Access to equity release does not depend on your income or your creditworthiness. You are not required to make any payments towards an equity release while living in your home.

There are some other more specific considerations, including your property type and construction, which I have discussed in greater detail in my article fully explaining equity release eligibility. It also includes a simple equity release eligibility calculator.

How much money can you release?

The minimum equity release is £10,000.

The maximum amount of money you can release will depend mostly on your age and property value.

let's look at a quick table showing the maximum equity release percentage at differing ages:

| Age |

Percentage of property value (LTV) |

| 55 |

27.5% |

| 60 |

32.5% |

| 65 |

37.5% |

| 70 |

42.5% |

| 75 |

48% |

| 80 |

53.3% |

| 85+ |

60% |

Some equity release plans are medically underwritten, allowing you access to further funds and/or obtain a lower interest rate if you suffer from specific medical conditions.

The types of modern equity release

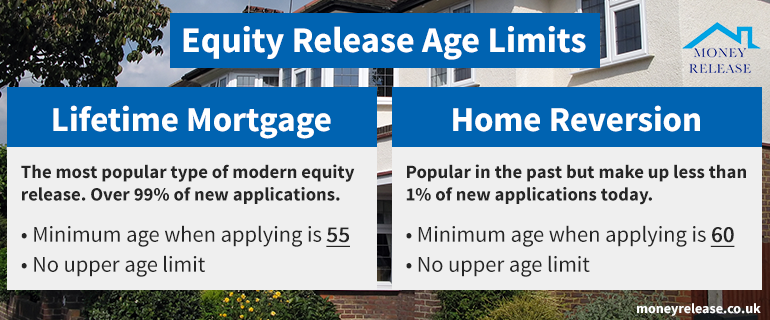

In 2025, there are two different types of equity release plan available, a lifetime mortgage, and a home reversion plan.

They can both provide you with a lump-sum of cash, but they are very different types of equity release.

A lifetime Mortgage (The most popular)

Lifetime mortgages work very similarly to residential mortgages and make up over 99% of new equity release plans. You retain full ownership of your home, and the mortgage lender places a charge on your property for the equity release loan.

A Home Reversion Plan

Home reversion plans were popular in the 90s, but are rarely recommended anymore. While they can offer you more cash, the downside is that they involve selling part or all of your home. For most people, this downside far outweighs the extra money that they can achieve.

Let's look at the table below, highlighting some of the similarities and differences between the two equity release plans currently available, a lifetime mortgage and a home reversion plan:

|

Home Reversion Plan |

Lifetime Mortgage |

| You retain full ownership of your property. |

No |

Yes |

| The mortgage lender has a registered charge on your property. |

N/A - You are selling part/all of your home. |

Yes - The same as a residential mortgage. |

| What is the maximum loan amount? |

Based on your age and your property value. |

Based on your age and your property value. |

| Your eligibility is based on your income and expenditure? (affordability assessed) |

No |

No |

| Mandatory monthly payments are required. |

No |

No |

| Voluntary payments can be made. |

Sometimes |

Yes |

| Minimum age of applicants. |

60 years old. |

55 years old. |

| Maximum age of applicants. |

No maximum age. |

No maximum age. |

| You have the right to live in your property for the rest of your life. |

Yes |

Yes |

| Your interest rate is fixed. |

N/A - You are selling part/all of your home. |

Yes for the lifetime of your mortgage. |

| Move Home When You Want |

No |

Yes |

| Downsizing Protection |

No |

Yes |

| Significant Life Event Exemption |

No |

Yes |

As you can see, lifetime mortgages are vastly superior in nearly every way. This is why over 99% of the equity release plans that I recommend are Lifetime Mortgages.

How does equity release get repaid?

Regardless of the type of equity release plan, you are not required to make any payments while living in your home.

The natural end of an equity release plan is when the last homeowner passes away or moves into long term care. Your estate will then be responsible for repaying the balance owed to the lender. Your property will most often be sold by your executors, although the sum owed can be repaid by any means.

With lifetime mortgages, you can make voluntary payments towards your equity release.

Different plans afford you varying amounts that you can repay each year without any additional charge. It is typical to have an allowance of up to 10% of the loan amount each year. But there are some plans which allow you to repay up to 40% without charge.

You must discuss your plans to make any voluntary payments with your equity release advisor, as they will be able to find a plan that best meets your needs.

Similarly, you should discuss your plans to repay your equity release plan. If you plan to repay before the natural term end, you could benefit from a plan with an Early Repayment Charge Waiver. Common waivers include:

Downsizing Protection

Allows you to repay your equity release plan without an Early Repayment Charge if you repay from the sale proceeds of your property when moving. Most commonly this feature is available from year 5 of your plan, but others from year 3. Some allow you to repay if your new home is not one which your existing equity release lender will lend on. Others allow you to repay regardless of if your new home is one which they would accept.

Significant Life Event Exemption

Allows you to repay your equity release plan without an Early Repayment Charge within three years of the first borrower passing away or entering long term care. For joint applicants, I strongly suggest you take a plan with this feature. We don't know what our feelings will be once our partner has gone, and this gives you the chance to grieve, plan, and act.

The benefit of draw-down equity release plans

Do you need money now, but may need more again in the future? A draw-down lifetime mortgage could be the perfect plan for you!

With draw-down equity release plans, you receive an initial lump sum of cash and have a pre-agreed reserve facility for your future needs. Money held in reserve does not attract interest and you draw funds directly from the lender when needed. The minimum for each draw-down is typically £500 to £5,000.

As part of our advice process, we discuss how and when you expect to spend your release money.

Our rule of thumb is that if you expect to spend the funds within 24 months, it makes sense to release the money now. This is because you are securing the interest rate now and are planning to spend the funds quickly.

If you expect to spend other monies after this, but within ten years, it may be more beneficial to take a reserve facility.

A reserve facility gives you a pre-agreed amount of funds which you can draw upon in the future, without having to go through the whole equity release process again.

Each subsequent draw-down from the reserve would typically need to be minimum £500 at a time, although some plans are £5,000. The lender assigns the interest rate associated with the draw-down at the point of request.

This saves you time by not having to have the property valued and go through the advice process again.

When making draw-down requests, the equity release lender would send you an offer to sign and return to them. Once the lender has received your signed forms, they would typically transfer you the money directly into your bank account within 14 days.

We recommend you discuss plans to make draw-down requests in the future with your advisor so they can advise you on the best course of action to take. However, nothing is stopping you from contacting your lender directly.

Important! You do not pay interest on any funds held in reserve. Interest is only charged on money you draw when you receive the additional funds.

This could save you thousands of pounds in interest over the term of the plan.

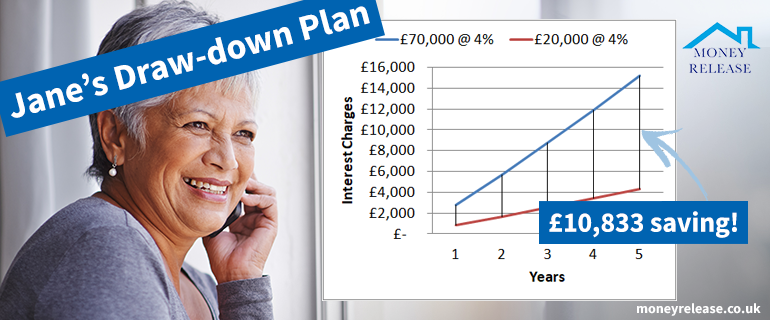

Let's look at an example of a draw-down equity release plan:

Jane knows that she needs £20,000 now to repay her existing interest-only mortgage.

Jane would like to stay in her property later in life but thinks that she would like a new bathroom and kitchen in five years. She may also need a new boiler too.

Initially, Jane thought about taking out £70,000 to cover these expenses, but her adviser recommended otherwise.

The solution

A lifetime mortgage providing an initial lump sum of £20,000, with a reserve facility of £50,000 for use later. Jane benefits from a 4% rate of interest on the money she needs now. However, she isn't stuck paying interest on the money needed in the future while it sits in her bank account not ready to be spent.

The difference

If Jane took £70,000 now at 4% interest, the amount owed would grow to £85,166 after five years (£15,166 in interest).

By taking £20,000 now, the amount owed after five years is only £24,333 (£4,333 in interest).

In this example, the reserve facility acts a bit like a savings account, whereby she can access the money as she needs it in the future without having to pay interest now.

By only taking the money she needs now Jane saves £10,833 in interest in the first five years.

As you can see, the difference can be massive!

What can you use Equity Release for?

The monies you release with an equity release plan can be used for anything you want!

What's more, the cash is tax-free!

With our extensive knowledge, we have compiled a list of the top uses of equity release.

But this list is not exhaustive, and there really are countless reasons people look at equity release.

Did you know that a recent survey conducted by London & Country suggests that around three million people are expected to be still repaying their mortgage when they reach state retirement age. That equates to 20% of UK homeowners!

With creeping costs and the sheer volume of interest-only mortgages that people have taken out, something has to give.

We have already learnt that any existing mortgages need to be repaid. So it should be of little surprise that repaying existing mortgages is one of the most popular uses of equity release.

We also see high net worth clients turning to equity release as part of wider inheritance tax planning.

The days of equity release being for those who "need it" are gone, and instead plans are much more mainstream.

Equity release is not for everyone, though, and there are considerable costs associated with the plans which need taking into consideration. Let's take a look at them now.

How much does Equity Release cost?

There are different types of costs associated with equity release plans to consider, including plan setup costs, charges during the plan's lifetime, and charges at the end of the plan.

Setup costs

When setting up an Equity Release plan, there are three main parties which are likely to charge a fee:

- The Equity Release lender;

- Your financial (equity release) adviser;

- Your legal adviser.

The Equity Release lender

Both lifetime mortgages and home reversion lenders will require a valuation placed on the property by a qualified surveyor.

The surveyors' job is to ascertain what value the property is likely to be sold for based on current property market trends.

They will also be looking into the specifics of your property, to ensure that the property conforms to the lenders underwriting criteria.

An example of this includes checking of construction methods, and materials used, when your property was built.

Lenders give you the option of paying for the valuation up-front or having a plan with a free valuation.

If you opt for a free valuation, the plan will usually cost more over the whole term. This is because the interest rate charged is often slightly higher on the monies loaned.

Most of the plans that we recommend include a free valuation. The reason this is usually preferred is that it lowers your risk of an unforeseen issue arising, and you making payment for the valuation up-front. For example, if the surveyor places a lower value on your property, or it does not match the lenders underwriting, you are not out of pocket.

The cost for a survey largely depends on the estimated value of your property. For an average property, a paid survey will usually be between £200 and £500.

Your Money Release adviser will discuss the options of paid and free valuations at your free initial consultation.

As well as the valuation, the lender may also charge an arrangement fee. This fee would only be payable if your equity release plan completes, and you get your money.

Arrangement fees can usually be added to the loan amount, or deducted from the equity release funds you will receive.

Your financial (equity release) adviser

Different financial advisers will potentially have different charging structures — Some require payment upfront, others on completion of your plan, and some will charge a mixture of both.

At Money Release, we do not charge anything up-front. The advice fee charged is only payable upon completion of your equity release plan. This means that you only pay for our service if you receive your money. If you decide not to pursue, you will not be charged a single penny by us for any works we have completed to date. We call this No-completion No-fee.

Your legal adviser

As well as requiring financial advice, you are also required to have legal advice from a solicitor.

You have free choice of the solicitor as they are acting for you. However, they must be qualified and able to practice equity release advice.

Different solicitors have different charging structures — Some charge by the hour, and others for the completion of work.

We are happy to recommend Barton Law for all your equity release needs.

Barton Law are one of the largest equity release specialist solicitors in the UK, and are currently processing more than 800 equity release applications per month!

Similar to Money Release, Barton Law charge on a No-completion No-fee basis, so you only pay for their service, when you get your money.

Please note, if you require any additional services your solicitor may charge additional costs. Such additional services include adding/removing people from the title deeds, registering your property with the land registry.

We suggest you budget for minimum total setup costs of £2,000, although these can all be paid with the funds from your equity release.

Charges during the lifetime of the plan

With most plans, there is no requirement to make any cash payments to the lender during the lifetime of the plan.

With lifetime mortgages, the highest cost during the lifetime of the plan is interest charged. Although most people do not make any payments during the plan term, interest is being accrued daily.

Generally, we think of 6% interest as average, with 5% being good and 4% being exceptional. If you need to stretch the amount you are borrowing, the interest rate may be 7% plus.

The interest charged can either be:

- paid for in full;

- partly paid for, or;

- it can be left to roll-up.

Most people choose to let the interest charged on their lifetime mortgage roll-up in the background, meaning they do not make any payments to the lender during the plan.

Instead, the full payment back to the lender is made either when the last borrower passes away or moves into permanent care.

If you can afford to make payments against the lifetime mortgage during the term, the amount of interest owed in total will be less over the duration of the plan.

Different lenders and different plans have varying options for making payments. Some allow you to make a monthly payment by standing order or direct debit. Some allow you to make ad-hoc payments over the phone or by sending cheques. Your plans to make payments back on the lifetime mortgage is discussed with your adviser so that they can source the most suitable plan for you.

There are some lifetime mortgages which give you a lower interest rate if you service some or all of the interest. If you stop making the monthly payments your home is not at risk, you just lose your discount to the interest rate.

Regardless of how much you decide to pay to the lender during the term, the agreed interest charges will be levied, and the lender expects to be paid back at the end of the plan.

We will see how the lender gets paid at the end of the plan shortly.

As most people choose to let the interest roll-up, the interest charged will be compounding in nature. This means that if you borrow £10,000 at 4% interest, the lender will charge £400 interest in year 1. If you do not pay the interest, the balance at the start of year two will now be £10,400 and year two interest will be calculated at 4% of this balance.

Compounded interest is one of the reasons that people do not like equity release plans. But it's not that simple, let's see why:

As you can see, while the equity release interest is compounding in nature, so is any growth on the property.

Most people have seen steady property growth in the past, and expect to see increases in the future too.

In our example, the retained equity in the property (property value - equity release balance) increases year on year, despite the equity release interest rate being higher than the property growth percentage rate.

Important: While the equity release interest rate is higher than the property growth rate, the lender only charges interest on the equity release balance. Whereas, any increases on the property are on the total property value.

In our example, the release value is 1/6 of the property value. This means that in year one, the interest of 5% is actually less than 1% of the property value (100% / 6 * / 5% = 0.83%).

Your equity release adviser can provide you with examples of how you could retain equity at your free initial consultation.

With Home Reversion plans, you will usually have no charges during the lifetime of the plan. Instead, as the reversion provider owns a percentage of your property, they will benefit from the sale proceeds at the end of the plan.

Some home reversion plans will require you to pay low levels of rent. This is either peppercorn type rent, or slightly higher, which allows you to receive a higher cash release against the property.

Home Reversion plans make up less than 0.5% of the equity release market and therefore are much less common than a lifetime mortgage.

Charges at the end of the plan

We have already learnt about costs at the start and during the plan. But what charges are at the end of the plan?

As the name suggests, Lifetime Mortgages are designed to run for the rest of your life.

The most significant payment needed to be made to the lender at the end of the plan is repayment of the capital, and interest accrued during the plan.

This could be paid from the sale of the property, refinancing the property, or from other cash.

While the property may be sold to repay the money owed; it is the executors of your will who will deal with repayment to the lender.

Important! As lenders know that probate, and potentially selling the property can take some time, they usually give up to 12 months in which to repay the monies owed.

If after this time the balance remains outstanding, they will contact the executors to find out how the money is due to be paid, and when they are likely to be repaid.

If the balance remains outstanding, the lender does reserve the right to force sale of the property; however, this is last resort, and they very rarely do this.

Very importantly, Money Release only recommends lifetime mortgages which are approved by the Equity Release Council. This means that the lifetime mortgage lenders have to adhere to a strict set of rules.

The Equity Release Council rules:

- For lifetime mortgages the rate must be fixed for each release or, if variable, the rate must be capped for the life of the loan.

- You must have the right to remain in your property for life or until you need to move into long-term care, provided the property remains your main residence and you abide by the terms and conditions of your contract.

- You have the right to move to another property subject to the new property being acceptable to your product provider as continuing security for your equity release loan.

- The product must have a “no negative equity guarantee”. This means that when your property is sold, and agents’ and solicitors’ fees have been paid, even if the amount left is not enough to repay the outstanding loan to your provider, neither you nor your estate will be liable to pay any more.

- All customers taking out new plans which meet the Equity Release Council standards must have the right to make penalty free payments, subject to lending criteria.

The no-negative equity guarantee protects you if the equity release balance exceeds the value of the property (possibly in the event of a house market crash). In such instances, the lender will not be able to recover any more than the sale price of the property. This gives massive peace of mind that no equity release debt can be passed on to your beneficiaries.

Speak with your advisor about how the lender is repaid at the end of the plan. They will discuss what this means to your executors and your beneficiaries.

Some lenders may also charge a small "closing the book" fee. Typically this is currently around £125 and is charged to close the account and remove the charge from the land registry.

Another area for consideration is if you do not want the equity release plan anymore and decide to repay early.

In such instances, an Early Repayment Charge (ERC) may be levied.

An ERC will not be levied at the natural end of the plan; either the death of the last borrower or the last borrower moving into long term care.

Different lenders have different ERC structures and various exemptions. Again, this is a crucial area of advice which your equity release adviser will provide you.

Common exemptions include:

- Death of the first borrower, or the first borrower entering long term care;

- Downsizing to another property;

- Selling your property and porting the equity release plan to your new property.

If any of these exemptions may be beneficial, make sure you ask your equity release adviser if they are included within your recommended plan.

If you have a home reversion plan, the reversion provider will be repaid as per the percentage they own of the property.

How do you get Equity Release?

The first part to getting equity release is to receive financial advice from a qualified equity release adviser.

We offer free initial consultations, either in your home or over the phone to explore your equity release options.

Following your initial consultation, your equity release adviser will provide a recommendation to you and discuss all the features and risks associated with your plan.

Should you wish to proceed with an application, your adviser will submit your application to the equity release lender.

We anticipate equity release to take around 8-12 weeks from the point of application to you receiving funds.

Some cases do complete quicker, and some can take much longer. If you are working towards a specific deadline, it is essential that you discuss this with your equity release adviser.

Once the application is submitted, the equity release lender will arrange a qualified surveyor to conduct a valuation on your property.

The surveyor will visit your property to conduct the valuation, and submit their report to the lender.

Your valuation happens at a time that is convenient for you. Usually, your valuation takes place within a week of the application being submitted to the lender.

The lenders underwriting team review the valuation report and look to make a formal mortgage offer to you.

The formal mortgage offer is sent to you, and your solicitors, hard copy in the post.

We expect that you will receive the formal mortgage offer within a week of the valuation.

The next part of the process is the legal aspects of equity release.

You are required to receive independent legal advice from your solicitors, and you will need to sign the formal mortgage offer in their presence.

The legal process does vary depending on your circumstances and your property; however, cases should complete within four weeks.

At the end of the process, the equity release lender makes payment to your solicitors. Your solicitors will transfer the balance to you, less any setup costs and repayment of any mortgages on the property.

Why should I use an Equity Release broker?

The Financial Conduct Authority (FCA), who supervises financial advice throughout the UK, requires equity release plans to be sold on an advised sale basis.

This means specialist financial advice is required to be given by a qualified adviser, who makes their recommendation as to which plan, if any, should be applied.

Most lenders do not offer advice and instead will recommend seeking specialist advice from a firm like Money Release.

Where lenders do offer advice, it is vital to find out if they provide advice on products from all lenders, or just their own.

Money Release specialises in equity release advice, and we offer advice on all types of equity release plans.

While a qualified equity release advisor has written this guide, it is not intended to be used as financial nor legal advice and should not be relied upon.

To understand the full features and risks of an Equity Release plan, ask for a personalised illustration.

Did this article answer your question?

If you found this article interesting, why not share it with your friends?

Simply click on the icons below to share.