With rising living costs, many people are looking for ways to supplement their income. If you are 55 or over, a lifetime mortgage could be a great option.

Equity release plans can provide you with access to ongoing cash to help supplement your income. Whether you are retired or not, if you are a homeowner, equity release can top up your monthly cash requirements. Importantly, money leant requires no monthly payments, and there are no affordability assessments.

But how do you know how much you need, and what are the drawbacks of taking equity release? Let's explore your options in greater detail.

In this guide, you will learn:

Equity release allows homeowners aged 55 and over to borrow money from the equity in their homes.

The most popular plan, a lifetime mortgage, gives you access to cash through a loan secured against your property.

Lifetime mortgages are very similar to residential mortgages; however, they require no monthly repayments or affordability assessments. Instead, the equity release lender looks at your property value and the age of the youngest homeowner to determine how much money they are willing to lend.

Cash released is tax-free, which can be a great way to supplement your income.

At the end of the plan, when the last homeowner passes away or moves into a care home, the loan is repaid, usually from the sale proceeds of the property.

When supplementing income, drawdown lifetime mortgages are usually the best type of equity release. With drawdown plans, you release an initial sum of money and have a pre-agreed reserve from which to draw.

Typically, you can draw from the reserve in a minimum of £2,000 tranches, which can be a great way to supplement your monthly income (although you would usually draw more than you require for one month).

When drawing from your reserve, you contact your equity release lender and request additional funds. They will quote you the interest rate for the withdrawal and, upon your acceptance, transfer the money directly to your bank account.

It typically takes less than two weeks from your request for funds until they land in your bank account.

I have written a helpful guide on accessing your reserve facility, which includes each lender's phone number.

Money held in reserve does not accrue any interest; interest is only charged on money borrowed. Furthermore, there are no administration charges for withdrawing funds.

Importantly, the money released is not income; it is a loan and is, therefore, completely tax-free.

This is excellent news, considering income tax bands are frozen until April 2028.

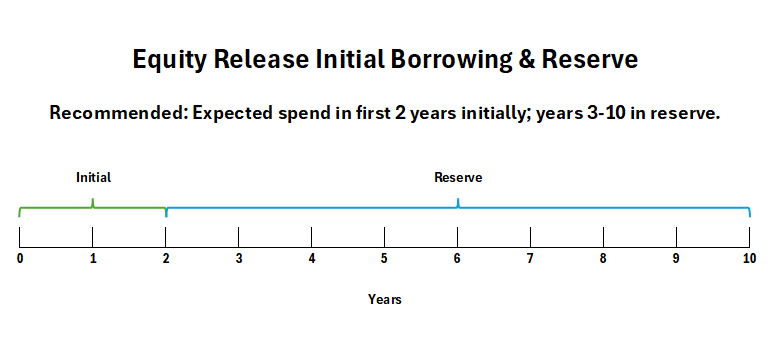

My general rule is to release enough money to cover anticipated spending for the first year or two. The reserve should cover spending needs for years three to ten.

If you need to supplement your income for more than ten years, it is usually better to review your additional needs in ten years' time rather than try to forecast so far into the future.

Remember, the smaller the borrowing facility, the lower the interest rate you will likely achieve.

Let's look at an example:

Mr and Mrs Smith plan to retire but will receive a £1,000 monthly income reduction.

They are happy to tighten their budget but are finding that they are likely to be short by £500 per month without drastically changing their lifestyle.

Having worked hard all their lives, they do not want to simply survive in retirement and would like to maintain their holidays and hobbies.

With a drawdown lifetime mortgage, they can release £12,000 to cover their needs for the next couple of years. Plus, they have access to a pre-agreed reserve facility of £48,000 for future withdrawals as needed.

A significant benefit of drawing money in stages is that you are only charged interest on cash released. Funds held in reserve do not attract any interest. Instead, when you draw the additional funds, they will have their own interest rate set to the prevailing rate at the time of request.

When considering the amount of income top-up you need each month, you should also consider the following:

- Changes to your future income

- Changes to your future expenditure

- The impact of inflation

Your equity release advisor will be best placed to discuss all your options before recommending a specific loan amount.

In an ideal world, to help you budget, you should plan for how much income you will need in retirement and what you will likely spend before stopping working. But this isn't always possible.

Your total income should be about two-thirds of your pre-retirement income to enjoy financial independence in retirement.

You should consider committed and discretionary expenditure, the income you will receive, and changes to your circumstances.

Finally, you can consider how equity release could help cover any shortfalls in what you are likely to receive.

Here is a list of information for you to gather to better help you calculate how much income you will need in retirement:

1. Complete an Income and Expenditure report

An Income and Expenditure report is a great way to look at your monthly cash position. It can help you see:

- How much income you receive from each channel each month

- What income is fixed, and what is variable

- Your committed monthly cash requirements

- How much you spend on discretional spending

- Where you can budget further to reduce your cash needs

- What surplus or deficit you are in each month

Where you identify a deficit, equity release can be a great option to help supplement your income, taking you back to a net positive.

Here is an Income and Expenditure calculator - all figures should be keyed after tax:

2. Pensions Forecast

It is helpful to regularly review your pensions to help forecast expected income in retirement. There are three main types of pensions that you are likely to have:

- State Pension

- Private Final Salary (defined benefit)

- Private SIPP (defined contribution)

State Pension

You can check the amount you are likely to receive from your state pension by vising https://www.gov.uk/check-state-pension or https://www.moneyhelper.org.uk/

The full new State Pension is currently £221.20 a week; however, the amount you will receive depends on how many years of National Insurance contributions you have made.

To receive the full State Pension, you must have at least 35 years of qualifying contributions. If you have fewer years, you will receive a percentage depending on the number of qualifying years you have.

For example:

- 35 years gives 35/35 * £221.20 = £221.20 per week

- 30 years gives 30/35 * £221.20 = £189.60 per week

- 25 years gives 25/35 * £221.20 = £158.00 per week

- 20 years gives 20/35 * £221.20 = £126.40 per week

- 15 years gives 15/35 * £221.20 = £94.80 per week

- 10 years gives 10/35 * £221.20 = £63.20 per week

- 5 years gives 5/35 * £221.20 = £31.60 per week

If you are not entitled to full State Pension, you can claim Pension Credit to top up your weekly income to £218.15 if you're single, or your joint weekly income to £ 332.95 if you have a partner.

Private Final Salary (defined benefit)

Defined benefit pensions are designed to provide you with a percentage of your salary for the rest of your life. Your company's pension provider can provide you with a pension forecast.

You will have likely received letters from them in the past confirming estimates of what you are likely to receive and confirming the dates for when any payments start.

Some will provide you with a fixed amount, while others will rise with inflation/CPI or similar.

You should also find out how much any spouse may receive if you pass. It is common for there to be 50% widow's entitlement, but this does vary, so it is always worth checking.

Private SIPP (defined contribution)

Defined contribution pensions are a pot of money made up of the amount of money that you have paid into it, plus fund growth over time.

The amount held is for you to draw from until depleted. If you pass away before spending all the money in your pot, you can pass it to your beneficiaries through your will.

Your pensions provider will be able to confirm the balance held in your pot and provide you with forecasts of how much income this can provide.

If you have lost touch with any pensions, you can use the Pension Tracing Service to obtain contact details for your pensions:

Pension Tracing Service

Telephone: 0800 731 0193

From outside the UK: +44 (0)191 215 4491

Textphone: 0800 731 0176

Relay UK (if you cannot hear or speak on the phone): 18001 then 0800 731 0193

Monday to Friday, 10am to 3pm

The Pension Service

Post Handling Site A

Wolverhampton

WV98 1AF

United Kingdom

3. Benefits Entitlement

I recommend using entitledto to find out what benefits you can claim. You can complete this yourself, or we are happy to as part of exploring if equity release is right for you.

Let's look at the benefits you may be entitled to claim:

- Pension Credit - If you are not entitled to a full State Pension, you may be able to claim Pension Credit to top up your weekly income to £218.15 if you're single, or your joint weekly income to £ 332.95 if you have a partner.

- Help with Council Tax - If you are entitled to Pension Credit you will also be entitled to a Council Tax discount.

- Help with heating costs - If you are entitled to Pension Credit you will also be entitled to

- Health benefits - If you are entitled to Pension Credit you may also be entitled to help with NHS dental treatment, glasses and transport costs for hospital appointments

- Free TV licence - If you are entitled to Pension Credit you will also be entitled to a free TV licence if you are aged 75 or over.

- Benefits for war widows or widowers - A one-off payment of £87,500 for eligible spouses in recognition of those who forfeited their pensions prior to 2015.

I have written a complete guide discussing if equity release is a good idea. The key pros and cons are:

Pros of Equity Release

- Tax-free cash - The money you release from your home is tax-free as it is a loan.

- No monthly payments required - You choose whether you would like to make payments or not. There is no obligation to pay each month, and you can make no payments for the rest of your life.

- Retain full home ownership - Lifetime mortgages (the most popular equity release plan) are secured against your home like a traditional mortgage. You remain the full legal homeowner.

- Reserve facilities - You can add pre-agreed reserve facilities, which you can draw upon in the future as you need. Minimum withdrawals are typically £500-£2000. You do not pay any interest on funds held in reserve until you draw upon them.

- Fixed for life interest rates - Avoid interest rate shocks in the future. With a lifetime mortgage, your interest rate is set at the plan's start and runs until the loan is repaid.

- Benefits in future property growth - Any future increases in your home's value will be for your benefit. By remaining in your larger value property, future increases could be larger than if you lived in a cheaper home.

- Bad credit accepted - Your eligibility is not affordability assessed, and while bad credit can preclude you from other finance, with equity release, it is not an issue.

- Downsizing protection - Where you can repay your equity release plan free of any penalty if you move home. Some lenders offer this if you move to a new home which they cannot lend on (and you cannot port your plan). Others allow you to repay without penalty if you sell your home.

- Significant life event exemption - If you borrow jointly with another homeowner who passes away or moves into care, you can repay your equity release plan without any early repayment charges. This is a fantastic feature for couples.

- No Negative Equity Guarantee - All Equity Release Council approved plans include this guarantee. Put simply, this guarantee means that you, or more specifically, your estate, will never owe more than the property is worth when it is sold.

Cons of Equity Release

- Less inheritance for beneficiaries - By releasing equity from your home, you will likely reduce the value of your estate. This means that you could have less money available to leave for inheritance to your beneficiaries.

- Potential loss of means-tested benefits - Your entitlement to claim means-tested benefits can be impacted by an equity release. As cash released is a loan, it is not declared as income. However, if you place funds into your bank account which take you over the savings thresholds, you may lose your entitlement to claim.

- Early Repayment Charges (ERCs) - If you repay your equity release balance early - before the death of the last borrower or the last borrower entering long-term care - you may incur an Early Repayment Charge. All plans allow you to make some payments without charge, and one plan allows you to repay after four years without any penalty.

- Compound interest - Should you choose to make no monthly payments, your equity release balance owed will grow. Meaning that you will incur interest upon interest already charged. Many people are put off by compound interest; however, they must also consider any compound growth that they will accrue on their property's value.

- Inability to take other secured borrowing - All equity release lenders require that they are the sole secured charge on your property. This means that if you want to borrow any more in the future, you will need to borrow it from your existing equity release lender. You are not allowed to have other secured borrowing on your property with an equity release.

- Reserve facilities aren't guaranteed - Every equity release lender has the right to restrict future lending, including any pre-agreed reserve facilities. They cannot ask for any monies leant to be repaid early, but in the event of a house price crash, the lender can withdraw a reserve facility (for example, if you are in negative equity).

- Porting risk - If you want to move to a new home in the future and take your equity release plan with you, it will have to meet the lenders' criteria at the time you move. This shouldn't be a problem, but you may have dreams of moving into a non-standard property or age-restricted assisted living, which may be unacceptable.

- Cannot rent out your home - Nearly all equity release plans are designed for owner occupiers, and you are required to let your lender know if anyone else permanently moves in with you. This is not normally a problem; however, if you were planning to leave your home and rent it out, the lender will treat this as you ending the plan. Therefore, you will need to repay your equity release and any associated ERCs.

- Setup costs - To take an equity release, you are required to have both financial advice from a qualified equity release advisor and legal advice from an equity release solicitor. The costs to arrange a plan can, therefore, be more significant than other types of finance. You should budget up to £3,000 to set up an equity release plan.

You should always consider all alternative options before taking equity release. Your equity release advisor will run through the options you may have available; however, here are some alternatives which may be available.

State Benefits

I recommend using entitledto to find out what benefits you can claim to supplement your income in retirement. You can complete this yourself, or we are happy to as part of exploring if equity release is right for you.

Let's look at the benefits you may be entitled to claim:

- State Pension - The new State Pension provides up to £221.20 per week; the amount you will receive will depend on your National Insurance contributions.

- Pension Credit - If you are not entitled to a full State Pension, you may be able to claim Pension Credit to top up your weekly income to £218.15 if you're single, or your joint weekly income to £ 332.95 if you have a partner.

- Help with Council Tax - If you are entitled to Pension Credit you will also be entitled to a Council Tax discount.

- Help with heating costs - If you are entitled to Pension Credit you will also be entitled to

- Health benefits - If you are entitled to Pension Credit you may also be entitled to help with NHS dental treatment, glasses and transport costs for hospital appointments

- Free TV licence - If you are entitled to Pension Credit you will also be entitled to a free TV licence if you are aged 75 or over.

- Benefits for war widows or widowers - A one-off payment of £87,500 for eligible spouses in recognition of those who forfeited their pensions prior to 2015.

Take in lodgers

If you have the space, taking in a lodger can be a great way to supplement your income. It can also be a great way to provide you with extra company.

If you are considering taking in lodgers and also taking equity release, you should be aware that there are some additional requirements.

Most equity release lenders allow up to two lodgers to live with you, but some allow for more. The lodgers must sign a document called an "occupancy waiver". This waives the individuals' rights to stay in the property if you were not living there, protecting both you and the lender.

Take on part-time work

Taking on part-time work can help provide you with additional income. You should consider the types of jobs that you are likely to be able to take on later in life.

By taking on part-time work, you can reduce or defer the amount of equity release that you may need.

Added benefits of working include:

- Social interactions with colleagues and customers.

- Potential health benefits from keeping active, both physically and mentally.

Sell other assets

If you have other assets, consider selling them to help supplement your income.

I don't suggest selling family heirlooms, which have high sentimental value. But if you have unwanted or unused items, you may want to consider selling them.

Equity Release

Finally, after considering all other alternatives, you should consider equity release as part of your later life planning.

Equity release plans can provide you with the funds you need now and ongoing cash requirements.

When ready, you should speak with one of our qualified advisors to explore how equity release can help supplement your income.

While a qualified equity release advisor has written this guide, it is not intended to be used as financial nor legal advice and should not be relied upon.

To understand the full features and risks of an Equity Release plan, ask for a personalised illustration.

Did this article answer your question?

If you found this article interesting, why not share it with your friends?

Simply click on the icons below to share.